Par Value vs Fair Value: 3 Differences Which You Must Know

The root word of the term ‘value’ is ‘val’, meaning worth, health or strength. The meaning of ‘value’ in the context of business is a quantitative measure of what a company is worth. This reflects the robustness of operations and the effectiveness of managerial decisions.

According to Warren Buffet, price is what you pay, and value is what you get. This means that value is subjective. It varies depending on the factors considered to decide the value and the need for computing the same. This gives rise to different types of values.

In this article, we explore the differences between two types of values – par value and fair value.

What are Par Value and Fair Value?

Par value (or face value) and fair value are two types of values widely used in the valuation of firms and financial instruments like shares and bonds. Ascertaining the value of a company as a whole as well as the value of its share capital are both important since they influence direct factors like the size of a firm, the safety of capital, adequacy of funds for running the business successfully, and derived factors like the value of an Employee Stock Option Plan (ESOP).

It is all the more relevant for a startup that is not listed, since it can affect key decisions on capital structure and setting up an ESOP trust. To know how to set up an ESOP trust, click here.

Three Distinct Differences Between Par Value and Fair Value

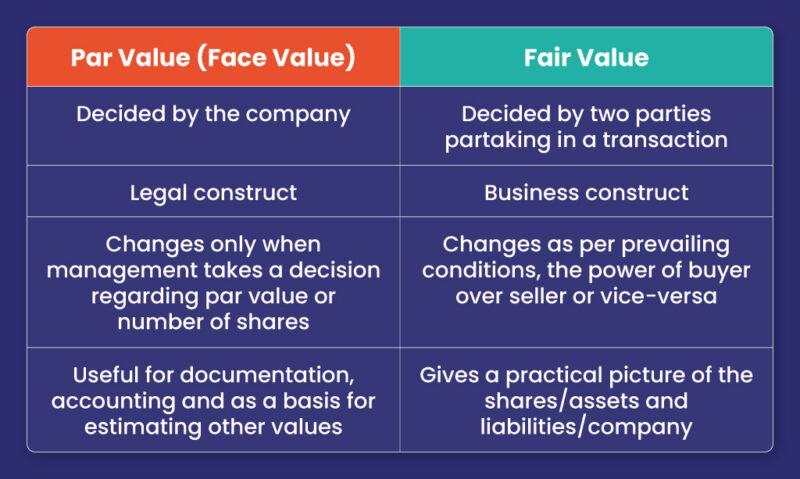

The par value and fair value are vastly different from one another. Here are three definitive differences between par value and fair value.

1. Meaning of the terms

Par Value:

When an entity first comes into existence, the amount of equity is one of the first things recorded in the books of accounts. This value is split into units, which are the shares. Each share’s value is the total equity divided by the number of shares. Both the number of shares and the par value are based on decisions taken by the top management. Therefore, they do not have a mathematical basis.

In India, the norm is to choose between Re 1 or Rs 10 as the par value of one share. However, a firm may choose even Re 0.01 or Rs 100, depending on its total equity and the number of shares it wants to issue. Having a higher number of shares gives better scope for issuing ESOPs.

Fair Value:

On the other hand, fair value is not fixed but ascertained using accounting techniques. The fair value is the value at which a willing buyer and a willing seller are ready to purchase and sell respectively. Although fair value is often confused with market value, they are not the same. Market value is more transparent since it is based on the price on a trading platform or marketplace.

The fair value need not necessarily be equal to the market value; it might be less than or more than the market value. This extends to ESOPs as well.

2. Applications

Par Value:

Par value is a legal construct. Its scope is limited to the equity capital of a company, and it does not reflect the performance or any other operational aspect. The par value has to be disclosed on the balance sheet of the company. A startup company considering the issue of shares at the outset needs to decide and state its par value in the Memorandum of Association.

Other than regulatory compliance, the par value is used for determining the issue price, which can be at par, premium, or discount. It is also critical in calculating dividends, which are typically declared as a percentage of the par value.

Fair Value:

Although there are legalities, regulations, and guidelines in the computation of the fair value of a business, it is not a legal construct but more of a trading concept. The fair value has to be estimated in instances such as consolidation and reconstitution of a firm, to name a few.

It is also beneficial to know the fair value since it reflects the true value of each asset and liability, if they need to be disposed of. It gives an insight into how much the company can generate from its assets or spend on its liabilities.

3. Changes

Par Value:

The par value of an entity’s equity (without considering retained earnings) mostly does not change. A change in the par value of a share doesn’t happen so easily or naturally either. Since the par value is a decision and not much of a calculation, the change is also a decision. When a company wants to increase the number of shares without impacting the value of equity, the par value is halved. This is known as a stock split and is the most common method of effecting a change in the par value.

A change in the par value causes a corresponding change in the market value, and consequently, the value of an ESOP. A reverse split is when the par value per share is increased, causing a reduction in the number of shares. The impact of such capital structure decisions needs to be reflected in the Cap Table of a company. Click here to view the features of trica equity’s Cap Table.

Fair Value:

Once a share is floated, its market value can keep changing. This is quite normal. The fair value of a company may also change frequently, particularly if it is an early-stage startup where there is a high possibility for a significant change in the revenue, operations, and other aspects, even within a short span of time.

One of the most common and easy ways to ascertain fair value is by listing a financial product on an exchange. This is called ‘marked to market’ and the market and fair value converge. In the context of startups this might not always be feasible or advisable. In such situations, it is through transactions that the fair value can be determined.

To Conclude

The meaning and computation of value in the context of business cannot follow a one-size-fits-all approach since the assumptions, inclusions and exclusions for assessing the value have to vary depending on the context and stakeholders involved in order to represent an accurate and logical financial picture of the business. The par value and fair value are both relevant and applicable, and a business needs to distinguish between the two.

Confused about documenting the different values of your company and updating them? trica equity’s cap table does this for you. Click here to know more.

ESOP & CAP Table

Management simplified

Get started for free