A Brief Guide to ESOPs, RSUs, and Employee Stock Purchase Programs

Human resources are one of the most vital assets for a company, and companies look for innovative ways to keep their employees motivated and retain them. Apart from the salary and perks, employers, especially startups, offer equity participation to their employees to keep them within the company fold.

Some popular equity participation options include Restricted Stock Units (RSUs), Employee Stock Options (ESOPs) and Employee Stock Purchase Programs (ESPPs). In this blog, we will provide a brief overview of all three to understand their differences.

What are Restricted Stock Units?

Restricted Stock Units (RSUs) are a compensation plan where the employee receives stocks after the vesting period. The vesting period refers to the duration employees must wait before claiming the allocated shares.

In this compensation approach, the vesting period is the only condition for the employees to get the shares. This method is popular among later-stage companies. For example, if a company offers 1000 RSUs to its employee with a five-year vesting period, the employee will receive these 1000 shares only after serving 5 years with the organisation.

Employees may provide RSUs in a phased manner. They may allocate 200 shares in the first year, 200 in the next year and so on. Most organisations offer these over a period, and the number of shares keeps increasing with the years.

In general, companies give RSUs in the form of stock or an equivalent amount of cash, depending on the stock value at that time. The decision to receive actual shares or a cash equivalent may depend on the employer’s discretion.

What is an Employee Stock Option Plan (ESOP)?

Employee Stock Option Plans (ESOPs) are the most popular form of equity sharing. They are a form of compensation that gives employees the right to purchase shares at a future date at a predetermined price.

In the case of ESOPs, the company fixes the price when it grants the stock option to its employees. However, the employee may choose not to purchase the shares at the given date if they don’t find the option economically prudent.

It should be noted that employees must work for a specified period in the organisation to receive ESOPs. As mentioned earlier, this duration is called the vesting period.

ESOPs usually also have a vesting schedule, during which employees get shares in tranches. The employer may provide a 25% share after one year, another 25% in the second year and the remaining f 50% after the third year.

Benefits of ESOPs

Employees benefit from ESOPs by being able to purchase shares at a significantly lower price than the prevalent market price of the stock on the vesting date.

Therefore, ESOPs are commonly used as a retention strategy and prevent short-term employees from acquiring potentially valuable company equity.

What is an Employee Stock Purchase Program?

Another compensation option available to employers to reward employees is the Employee Stock Purchase Program (ESPP).

Under ESPP, the employer offers the employees regular ongoing purchase of equity shares at a predetermined discounted price. Employees have the prerogative to purchase stocks at a discounted price.

There is usually a month’s window to purchase shares for the employees. The purchase amount is linked to their salary. This arrangement is almost like running a SIP where the employee invests in the company stocks.

Employers may allow employees to invest 10-15% of their monthly salary in the ESPP/month. For example, if an employee earns Rs 30,00,000 annually, they can invest Rs 3,00,000-4,50,000 at the end of the year in the company’s shares at a discounted price. Also, if the prevailing market price of the company share is Rs 100 and the company offers a discount of 15% for employees, the staff can buy the share at Rs 85 under this scheme.

Benefits of ESPPs

The Employee Stock Purchase Program helps employees enjoy a substantial gain (the difference between the exercise value and the market value) right on the first day of allotment.

As the employers deduct a fixed amount periodically, there is no financial burden on the employee at the time of purchase.

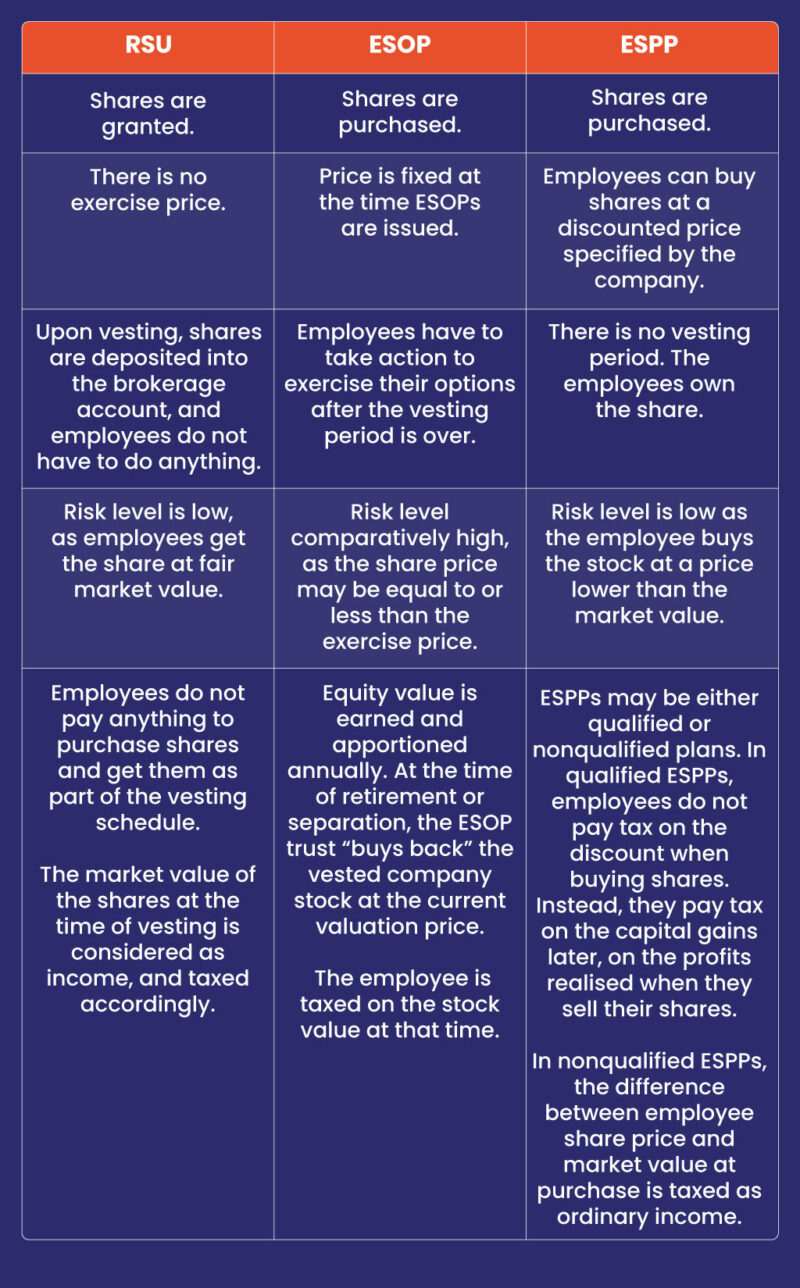

Comparison of Restricted Stock Units, Employee Stock Option Plans and Employee Stock Purchase Programs

In Conclusion

Both employers and employees should clearly understand the compensation options before they opt for it because each has its merits and specific use cases. Using the appropriate combination of equity compensation options can help retain and attract competent people in a competitive market.

trica equity brings technology-enabled equity management solutions to offer startups efficient handling of cap table and ESOPs, whereas it empowers investors with easy organisation and tracking of theory investment portfolios. With trica, you can manage your ESOPs effectively and draft an equity incentive plan for the workforce.

Schedule a demo to learn more!

ESOP & CAP Table

Management simplified

Get started for free