Worried About Your Tax Outgo on ESOPs? Calculate Yourself!

The exponential increase in startups has rendered Employee Stock Option Plans (ESOPs) quite popular. While startups leverage ESOPs to attract and retain top talent, employees think of ESOPs as a means to generate considerable wealth. Employees, in the process, align the trica equity lves closely with the organizational roadmap, knowing that liquidation will make them millionaires one day.

However, generating liquidity is not easy. A plethora of ESOP tax implications surround both startups & employees, and understanding all of them may be tricky. In this blog, we bring all you need to know about ESOP-related tax implications. But before moving to the tax part, it is essential to be familiar with these three key terminologies that are associated with ESOPs (you can read our complete ESOP dictionary here)

Vesting Date: The vesting date is the date on which the employee is entitled to buy shares after fulfilling the conditions agreed upon in the Share Holders’ Agreement

Exercise Period: After vesting, the employee earns the right to buy the ESOPs granted to them. However, the employee can buy those shares only during a certain period of time. This is the exercise period

Exercise Price: Exercise price is the price at which the employee buys the shares. This price is, in most cases, lower than the prevailing FMV (Fair Market Value) of the share

When it comes to calculating the tax on ESOPs, many parameters are factored in the equation. In India, taxes on ESOPs are levied at two instances:

- First, at the time of exercise, as a prerequisite on the employee’s annual compensation

- Second, at the time of liquidation, when the employee sells the exercised shares

#1. Tax implication at the time of exercise of shares

Tax incidence arises only when the employee exercises ESOPs; there is no tax implication during the vesting period. Recently, in #Budget2020, the Finance Minister proposed the deferral of exercise tax to the time of sale of shares, 5 years, or when the employee quits the company, whichever is earlier.

(For more insights on how #Budget2020 will affect ESOPs in startups, click here!)

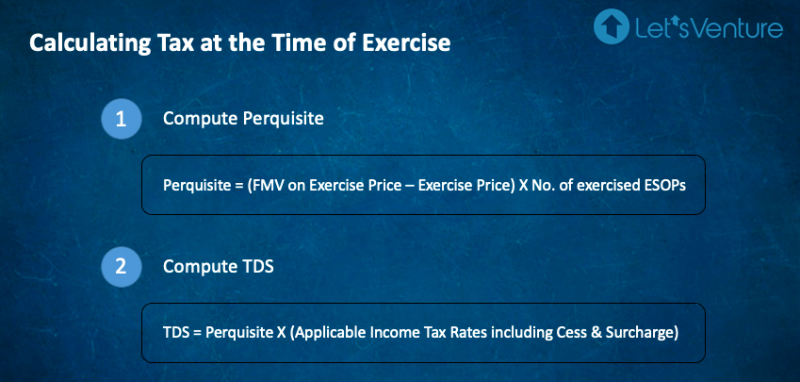

Upon exercise, if the Fair Market Value (FMV) of the share is more than the exercise price, it becomes a profit for employees, and such a gain is treated as a ‘Perquisite’ in the hands of employees as per Section 17 of the Income Tax Act, 1961. As a result, the employer (i.e. startup) is liable to deduct TDS on such a prerequisite, depending on the tax bracket in which the employee falls, and deposit the same with the government before the 7th of the next month. This amount appears in the employee’s Form 16 and is included in his total salary.

Key Takeaways:

- TDS is deducted only on those shares that are exercised

- Companies are liable to deduct TDS on exercised ESOPs

#2. Tax implications on the sale of ‘exercised shares’

If the employee sells his ‘exercised shares,’ he will have to pay capital gains tax on the profit that he makes from the share sale.

Capital gains are of two types:

- Short Term Capital Gain (STCG)

- Long Term Capital Gain (LTCG)

Calculating Taxation on Capital Gains

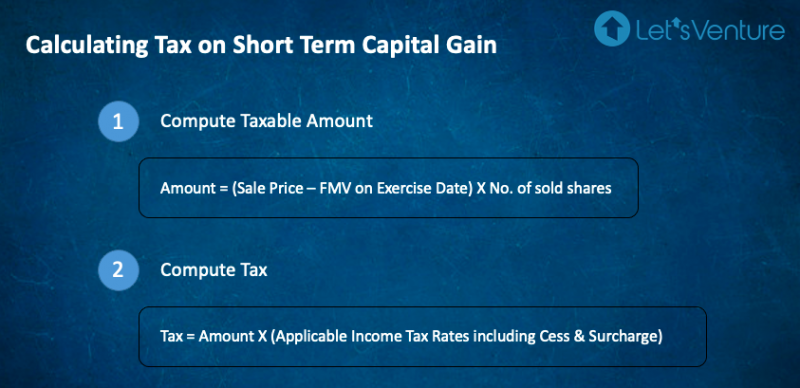

Tax implication on STCG:

STCG arises when shares are sold within 24 months of exercising.

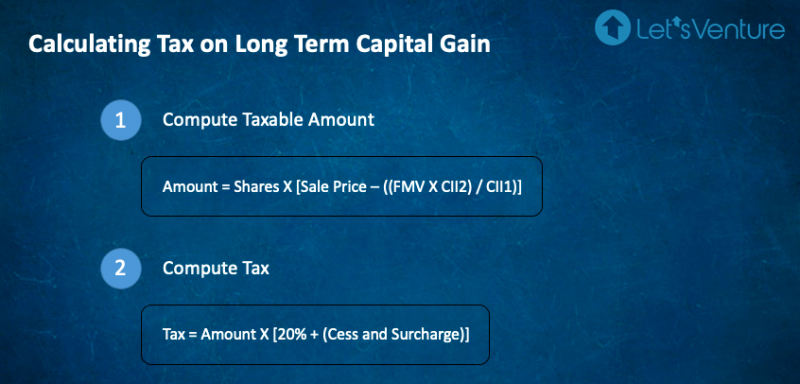

Tax implication on LTCG:

LTCG arises when shares are sold after 24 months of exercising.

Rate of tax = 20% (after indexation of cost)

Indexation cost is basically factoring in the Cost Inflation Index (CII)

Other factors

- Tax Residential Status: As a general rule, the income tax rate of an employee is decided based on their tax residential status (‘TRS’). TRS is governed by Section 6 of the Income Tax Act. If an employee is a tax-paying resident of India at the time of exercise, the TDS would be calculated based on the normal Indian tax slab, but if he is treated as a non-resident, then the tax rate might differ. Double Tax Avoidance Treaty benefit is also available in such cases.

- Advance tax: Since capital gains will add to the total income, advance taxes are calculated accordingly.

Understanding ESOP Tax – An Example

Imagine a Senior Product Manager, Rahul joined a startup ‘Fix-It Solutions’ as one of the early employees in 2014. Upon joining, Rahul was granted 100 ESOPs at an exercise price of INR 1000 per share, and the company’s valuation at the time was INR 20 lakh. The vesting period according to the ESOP policy of the startup was 4 years.

In 2019, Fix-It Solutions raised its Series D round, and its valuation went up to INR 6000 cr. At this point, Rahul’s vesting period is already over, and he decides to exercise all of his 100 options. The FMV of each share on the date of exercise is INR 1,94,000.

Total exercise price = INR (100 X 1000) = INR 1 lakh

Assume, he falls in the 30% tax bracket.

Upon exercising,

Perquisite = INR (1,94,000 – 1000) X 1000 = INR 1.93 cr

TDS = 30% X Perquisite = INR 57.9 lakhs

(applicable cess & surcharge will be extra)

Total selling price = INR (1,94,000 X 100) = INR 1.94 cr

Assuming sale is done at the time of exercise,

Short Term Capital Gain = zero

Tax on capital gain = zero

Amount the employee gains (after taking care of taxes) = 1.94 cr – 57.9 lakh = INR 1.36 cr

If you are looking for an easy to use tool to create your ESOP policy and manage ESOPs for your team, check out trica equity.

Check out LetsVenture for investing in startups or raising funds!

Disclaimer: This article has been prepared for general guidance on the subject matter and does not constitute professional advice. The matters described herein are general in nature and have not been evaluated based on applicable laws. You should not act upon the information contained in this note without obtaining specific professional advice. No representation or warranty (express or implied) is given as to the accuracy or completeness of the information contained in this note. LetsVenture Technologies Private Limited, its partners, employees, and agents accept no liability, and disclaim all responsibility, for the consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any decision based on it. Without prior permission of LetsVenture Technologies Private Limited, this note may not be quoted in whole or in part or otherwise referred to any person or in any documents.

ESOP & CAP Table

Management simplified

Get started for free