Stock Split vs. Bonus Issue: All You Need to Know

Several Indian start-ups have investors based out of Singapore and Mauritius. These Indian start-ups have recently suggested listing their shares on Indian stock markets as part of their initial public offering (IPO). If the price per share is too high, the company will lower it to make it more affordable to small retail investors.

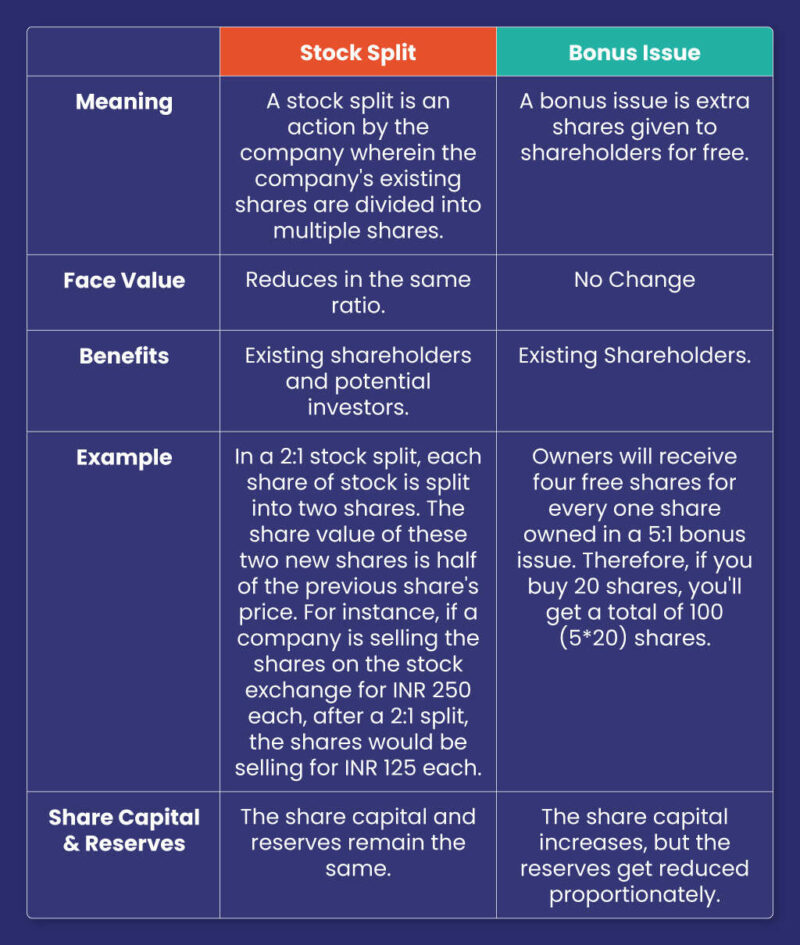

The price per share can be decreased in two ways: the company can offer bonus shares, or shares can be subdivided into shares with lower face values (stock split). Both of these strategies achieve the desired objective prior to a public offering, namely a lower price per share.

Hence, start-ups issue bonus shares and stock splits to promote retail participation, mainly when their share price is relatively high, and investors find it difficult to buy shares. This is also known as pre-listing bonus or stock split

What is a Bonus Issue?

A bonus share is a free additional share given to shareholders to appreciate their support. Bonus shares are free shares issued by a firm to current shareholders. Bonus shares are distributed in proportion to an investor’s shareholdings.

For example, if a company offers 1:5 bonus shares, it means that the shareholder will receive one free share for every five shares purchased. As a result, an investor who has 100 shares at the bonus will now own 120 shares.

Hence, in a 1:1 bonus issuance, the share price will decrease by 50%. However, when stock prices rise, investors usually benefit in the long run. Moreover, the distribution of bonus shares is tax-free.

What is Stock Split?

When a company splits its outstanding shares into more shares, it is a stock split. The market cap of the firm and the value of each shareholder’s investment stay unchanged after a stock split, but the value of each share decreases as the number of shares increases.

A stock split is used to attract new investors and increase market capitalization in the medium to long term. In addition, a stock split is viewed by investors as an indication that the company is doing well; hence, the stock value goes up because of investors’ excitement.

Difference Between Bonus Share and Stock Split

A bonus issue occurs when existing shareholders are given an additional share, whereas a stock split occurs when the same share is split into two or more claims based on the split ratio.

Bonus shares are beneficial to existing owners, and stock splits are advantageous to both current and new investors.

The company’s fundamentals will be unaffected by the stock split and bonus share issue; the issued share capital, profit, and revenue will remain unchanged. Bonus Shares are issued only to existing shareholders. Existing shareholders, as well as prospective investors, will benefit from the stock split.

The number of stocks will be doubled, and the price will be changed if the firm decides to split its stock from a face value of ten to a face value of five. The face value of bonus stocks remains unchanged; however, the price will be adjusted in proportion to the bonus ratio.

What Difference Does It Make to Investors and Companies?

A firm uses both strategies to reward its shareholders. In the case of a stock split or a bonus issue, shareholders are not required to pay any additional fees.

In a stock split, existing shares are split in half. As a result, the number of shares available for purchase grows while the price of each share lowers, but the overall investment remains unchanged.

Many companies see bonus issues as a viable alternative to dividends. Dividends and bonus issues are payments made to shareholders from a company’s net profits; dividends are paid to shareholders in the form of new shares, while bonus issues are paid in additional shares. As a result, it increases the value of its stock and makes it more enticing to investors.

It is also an effective way to increase retail participation. If the stock is trading at a high level, purchasing it may be difficult. A bonus issue enhances a company’s liquidity and broadens its share base.

On the other hand, a company may announce a stock split if it wants to cut the price of its shares and make them more accessible to investors. This is also done to boost the company’s stock’s liquidity.

trica is your partner for equity management and liquidity. We make equity transactions easy. We fundraise from our global VC (venture capital) network and family offices and create liquidity for shareholders and employees. Everything we do is technologically enhanced and infused with our unique personal touch. For more information, connect with us.

ESOP & CAP Table

Management simplified

Get started for free