Stock Options vs. RSUs: Key Differences Summed Up

The concept of pay for labor has been around for millennia, but the forms of payment themselves have varied wildly through the ages… right from rations to salt and finally to money.

The compensatory system we know today emerged from the Commercial Revolution: trade-based economies provided the push for formalized salaries and structured compensation packages.

Benefits and perquisites, such as employee ownership, soon made their way into these salary packages. Granting employees sweat equity and stock ownership dates back to the mid-19th century when Benjamin Franklin was the boss-man in town.

Although stock options and ownership plans faced downturns through the years, they have retained their value since the 1950s and been an aid to both employers and employees alike. May it be the 2008 economic recession or the dot com bubble before, businesses have known that equities are the way forward. While we are at the cusp of another such winter now, the inflation reaching unprecedented peaks, a war-induced stagflation around the corner, stock options are still the preferred choice.

Today, we understand the value of company stock and how this is an ideal employee incentivization tool. Attracting and retaining talent can often be achieved through equity compensation.

Below, we look at two popular forms of equity distribution: stock options and RSUs (restricted stock units). More specifically, we take you through the basics, the differences, and where you can expect to see these offered as compensation.

The Basics: What Are Stock Options and RSUs?

To understand what makes these forms of equity distribution, we must first understand them and their functions individually.

Stock Options

Stock options give holders the right to purchase company stock in the future (on what is known as the vesting date) at what is known as an exercise price.

This exercise price is determined on the grant date (the day the options are issued) and is typically lower than the FMV (fair market value). Employees can exercise their right to purchase these options or simply hold them.

Restricted Stock Units (RSUs)

When restricted stock units are issued to an employee, the company commits to giving an employee a certain number of shares in the future without upfront payment.

These units are subject to vesting periods and depend upon employee performance and/or length of employment at the company.

You may also be interested in: What Are the Different Types of Vesting and Why Do They Matter?

Stock Options and RSUs: What Sets Them Apart

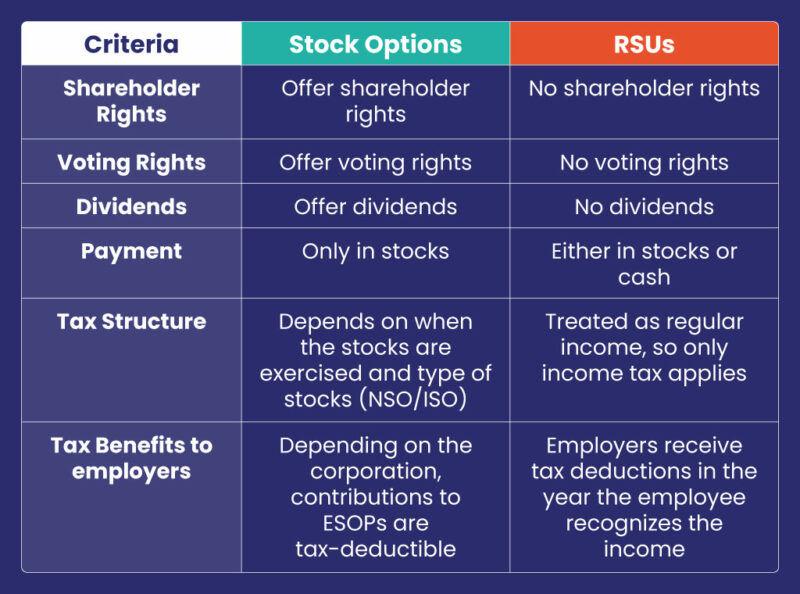

Now that we understand stock options and RSUs at their core, we can further dissect their differences. Outlined below, they differ in three broad categories:

1. Rights and dividends

The rights granted to holders of stock options and RSUs differ significantly. Holders of stock options receive full shareholder rights, voting rights, and dividend rights upon exercising the option.

Once the options are exercised, holders become owners of the underlying shares and hence, are entitled to the rights that go along with it.

On the other hand, RSU holders have no shareholders or dividend rights, even after the vesting period. However, holders are entitled to restricted voting rights once the RSUs are paid out and converted to common shares.

2. Settlement

Upon vesting, holders are entitled to a settlement. As a result, employees will receive their compensation only in stock when it comes to stock options. However, restricted stock units can be settled either through shares or cash compensation (based on the fair market value of the stock on that particular day).

3. Taxation

Taxation varies for these equity distribution methods because of the differences in their underlying structures and settlement types.

More specifically, holders of stock options could face either regular income taxes or long-term capital gains taxes. Taxation depends on when holders choose to exercise their options and their type of stock option (NSOs or ISOs).

Contrastingly, restricted stock units are typically taxed as ordinary income when they vest.

Furthermore, taxation from the company’s point of view is equally complex. For example, companies must either collect or withhold income and employment taxes on the exercise for stock options.

And for RSUs, companies must ensure that they have sufficient liquid funds to cover the tax obligations due on settlement. The failure to comply with tax obligations could result in severe penalties for companies and individuals.

Diving Deeper: Stock Options vs. RSUs, and the Correlation to Company Type

Offering compensation in the form of company equity is a commonality in the corporate world. However, how equity is distributed is primarily governed by company maturity and finances.

There’s a clear trend in this form of equity distribution being popular with early-stage, high-growth startups regarding stock options.

This is due to a few factors, the first being that stock options are a good bet for companies trying to get employees invested long-term in the growth of their nascent businesses. This also leaves the company and the employee with stock options with a larger room for growth in stock value, even when income streams remain low or uncertain as the startup optimizes growth.

In contrast, restricted stock units are favored by more mature companies, with reliable cash flows and ample funds. Public companies, and startups with high valuations, typically fall under this ambit. Later in the company’s life, there is greater faith in mature stock and its value at this more mature point.

Takeaways

Correctly handling equity distribution is key to ensuring the success of many startups and is a show of good faith for more established companies. However, how corporations implement employee ownership of company stock depends on the above mentioned factors.

However, even though the distribution channels may differ, there will always be an underlying need to manage equity efficiently. Having an uncluttered, transparent view of finances and employee ownership is critical in maximizing rewards for everyone involved.

trica equity fits in the picture here. Look no further for a seamlessly integrated equity management platform that will help you strategically minimize costs and successfully incentivize talent. Book a demo today to see what we’re all about.

ESOP & CAP Table

Management simplified

Get started for free