Phantom Equity: How Is It Different From True Equity

Equity is now a commonplace form of compensation, and it is vital in ensuring employee retention. However, the particulars of equity distribution plans can vary in how and when shares are allocated.

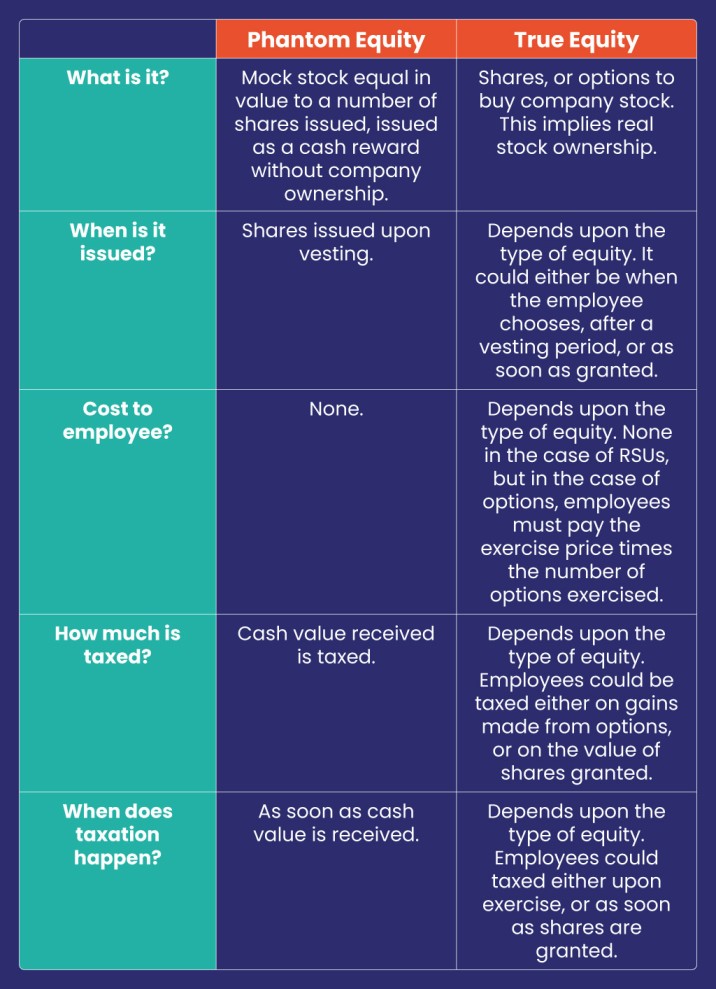

True equity always entails the actual transfer of stock ownership to an employee. Contrastingly, phantom equity is the flip side of such true equity distributions. We detail exactly what phantom equity is, how it works, and why companies choose to employ it as a compensatory tool.

What Is Phantom Equity and How Is It Different From True Equity?

As we hinted above, phantom equity is the ‘shadow’ side of true equity. This means that no stock is distributed in phantom equity distribution plans.

Select employees (usually high-level) receive ‘mock stock.’ This entails receiving the benefits of stock ownership but no real company stock. Phantom stock is essentially a simulation of stock distribution that protects equity from further dilution but allows employees to gain from company share growth financially.

Phantom stock units mimic the price movements of real stock units and will pay out any resulting profits in the same way real stock would.

You may also be interested in: How Transparency in Cap Tables Can Benefit Your Startup

How Does Phantom Equity Work?

Now that we understand that phantom equity doesn’t involve issuing real stock let’s delve into how phantom equity distribution plans work.

Even though the phantom stock is an abstract concept, it still holds financial value like its real counterpart. This cash value will be paid out to qualifying employees once the requisite waiting period is over (usually two to five years). Phantom stocks can be awarded in two ways, which we detail below:

Appreciation only plan

Appreciation-only stocks bar recipients from receiving the full value of a phantom stock when it is cashed out. Instead, recipients receive only the ‘profit’ or appreciation value of the stock. This is essentially the difference between the stock’s current value and the value of the stock when granted.

For instance, let’s say that Jane Doe was granted 1000 phantom shares in July 2020, when they were worth $40. To receive the cash value of these shares, Jane must remain at the company for three years.

Assuming that Jane stays with the company until July 2023, when the shares are worth $60 each, Jane will receive $20,000 ($20 appreciation earned per share, for 1000 shares).

Full value plan

Full value phantom share plans payout recipients the entire worth of the shares at their current price. This means initial phantom share value plus any stock appreciation.

For instance, let’s say that John Doe was granted 1000 phantom shares in July 2020, when they were worth $40. To receive the cash value of these shares, John must remain at the company for three years. Assuming that John stays with the company until July 2023, when the shares are worth $60 each, John will receive $60,000 ($60 per share, for 1000 shares).

Advantages and Disadvantages

Phantom equity plans have proven very advantageous to businesses that wish to incentivize employees to stay with the company without transferring any more ownership away from founders.

This allows retention of power since employees hold no voting rights. As a result, phantom stocks afford companies a greater level of flexibility than true equity distribution plans, but that’s not to say there are no disadvantages to it.

In fact, companies can incur significant costs in implementing phantom equity distribution plans. Higher outgoing cash flows are due to conducting necessary external equity valuations and the cash payout for phantom stock.

To avoid cash depletion, companies can circumvent this problem with a ‘conversion clause’ that converts phantom stock to real stock at payout.

Which Companies Should Consider a Phantom Equity Plan?

Deciding on an equity distribution plan is one of any business’s core decisions. There are many things to consider, but phantom equity comes with a few extra considerations, which we detail below:

- Growth: is the company expected to grow? Phantom equity sharing plans only perform well in steadily growing businesses.

- Profit-sharing: assuming the company’s growth is steady, is it feasible to share 5%-15% of those profits with employees?

- Value: even if it is possible to share profits from growth with employees, is the dollar value of that share meaningful enough to keep employees around?

- Key employees: assuming good growth and meaningful profit sharing are in place, it is equally important to count and consider any employees indispensable to the very growth businesses depend on.

A summative view

The Bottom Line

Whether you choose phantom equity or true equity takes your fancy, and equity management will always be necessary for growing businesses.

Having a secure, centralized, and customizable platform from which company owners can easily manage everything equity is a necessity. trica equity’s management software does precisely this. Try it out and book a demo today.

ESOP & CAP Table

Management simplified

Get started for free