Equity Compensation for Startup Advisors: How Much to Offer?

Advisors play a crucial role in most startup journeys, which is why it is a tough call for most founders to compensate them. In confusion, they offer more or sometimes less, thus impacting the business’ growth and relationship. But, worry not, here’s a framework that helps you get started.

How Much to Offer as Equity Compensation to Advisors?

Now addressing the question: most early-stage startups pay advisors with 1% equity. The amount differs based on the advisor’s expertise, role within the organization, and stage. It also depends on other parameters discussed below.

What type of advisors are they?

The startup advisor’s role usually falls into one of these categories:

- General – General Advisors, do not sit on the company’s board. It does not mean they are less experienced; they are less involved in strategic decisions. A former CMO from an industry different from the startup may be valuable as a General Advisor.

- Board – Former founders or industry experts usually serve as Board Advisors. They are asked to contribute to the strategic direction of the organization. They take the lead to help shape the company’s strategy and decision-making.

- Technology – Technology Advisors can assist companies with technical expertise. If needed, they bring the best tech stack practices, system architecture, or even design concepts. These individuals often shape the long-term strategy and roadmap from the technology perspective. They take away the load and time of an overburdened CTO.

- Others – These people are not financially sound enough to be investors or have the time to be employees. But they have a specific reason or domain that hooks them to contribute to the startup’s growth.

Parameters on Which Advisor’s Compensation is Calculated

The compensation is calculated based on the type of advisor and is forwarded via cash or equity, or both.

Cash vs. equity compensation

It is often a matter of personal preference how advisor equity is compensated – by salary, equity, both, or neither. However, how the different advisory roles are compensated is remarkably different.

General Advisors, for instance, are predominantly compensated by equity. In contrast, tech advisors often receive cash and equity compensation, while Board Advisors are likely not to receive any compensation.

So, how is this decided? Compensation depends on company valuation, the number of days worked, and the advisor type of breaking it down.

Take a look at the details below:

Compensation based on company valuation

If you have a high valuation for your company, the advisor equity should be less. However, since the median value for both categories is the same as 1%, we can conclude that advisors are given 1% equity on average irrespective of the company’s valuation.

Compensation based on work-time

Even though the amount is highly variable, these are the features of a standard contract. Depending on the organization’s needs, the contribution of time will fluctuate.

It can be an hour or two a week to more than two days a month. Here again, the advisor equity should be “really” worth the contributions they make for the growth of your business.

Sometimes they just add visual appeal to your pitch deck or website. The reward depends on their “time.” How much value did they add to your company with their time?

Compensation based on role

There’s less equity for general advisors than for board members or technologists. This is because General Advisors are chosen more often to appear in a pitch deck and website.

On the other hand, it may be that Board Advisors have a defined director role with legal responsibilities, and Tech Advisors work longer hours (on average 43 days a year) than the other advisors.

So, now this might look good on paper, but how is advisor equity applied in reality? We are answering that by using the Travis Kalanick method.

The Travis Kalanick Method

Travis Kalanick is an American business entrepreneur. He was also the former CEO of Uber. He believes math matters while doing equity compensation. If done correctly, employees, investors, and advisors can benefit from equity compensation.

Here’s how it works:

- First, determine what value this advisor can add as a full-time employee.

- Then, calculate the fraction of full-time you expect them to contribute.

- The full-time position is typically a salary and equity arrangement. The compensation should move into stock when the advisory role is based on an appropriate valuation.

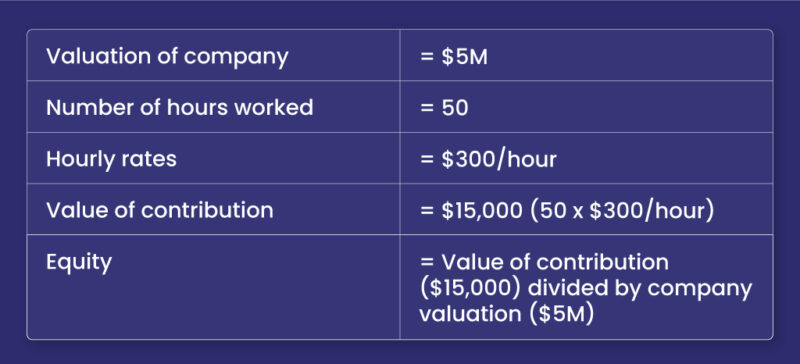

These are the inputs to this model:

- If you haven’t raised funds yet, you may need to value your business at $5–10M.

- A total number of hours they contribute in a vesting period. (Let’s say 1 hour per week over one year comes out to about 50 hours)

- Add the hourly rate of their salary. It is also possible to use hourly / daily rates, but they are usually higher and used for short projects.

Now, let’s take this example below:

The equity compensation would be 0.3%

It is just an example and will need to be tweaked as per your business needs and how much contribution or value an advisor brings to it.

Please keep in mind the vesting periods and cliffs when talking about value.

Vesting Schedules and Cliffs

An advisor receives between 0.25% and 1% of shares, based on the startup’s stage and their advice. In such cases, founders can receive value for their shares and retain the right to replace advisors without sacrificing equity.

One best option you can set up vesting over two years with a six-month cliff. During the first six months, if the partnership doesn’t work and the advisor leaves, the company keeps the equity.

And lastly, offer whatever feels right to you to get value for your equity. No matter how little or how much they contribute, using advisors in the right manner can make them a powerful source of talent that will make your company grow to new heights.

At trica, we will help startups solve their equity puzzles through technology and specialization. So get in touch today for your startup’s cap table and ESOP management needs.

ESOP & CAP Table

Management simplified

Get started for free