ESOP Accounting for Indian Startups Using the Graded Vesting Method

Companies that follow Accounting Standards may choose either the graded vesting method or the straight-line method for option valuation for bookkeeping ESOP expenses. But, companies that follow Indian Accounting Standards (Ind AS) are required to use the graded vesting method for booking their ESOP expenses.

trica equity digitizes this ESOP accounting as a whole, and you can reach out to us for details on how we do it.

Graded Vesting Method for Indian Accounting Standards (Ind AS)

Under an employee stock option plan, option grants may vest on more than one date – spread over months and years (including cliff or otherwise). Under such a vesting schedule, each grant needs to be segregated into an identifiable group based on the vesting date. Each group will have different vesting periods and expected life; therefore, each vesting date should be considered a separate option grant and accounted for accordingly.

Let us take an example.

Quicky is a startup and has issued 1,000 options on 1st April 2020 to Aditya with graded vesting of 25% per year starting from 1st April 2021 (i.e., after a one-year mandatory cliff). The option value was INR 3,000 per option as on the grant date, based on the Black-Scholes Model (a pricing model used to determine the fair price or theoretical value for a call or a put option based on six variables such as volatility, type of option, underlying stock price, time, strike price, and risk-free rate).

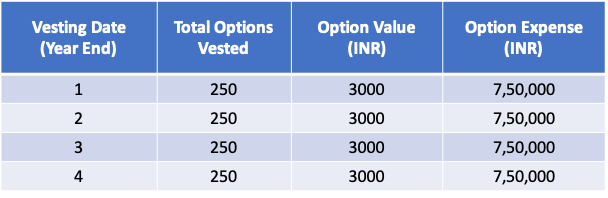

First, we will calculate the number of options vested per year and their respective expenses based on the option value as of the grant date.

The option expenses determined above will be recognized over the respective vesting periods. Hence, the option expenses of INR 7,50,000 – vested in Year 1 – will be booked completely in Year 1. Similarly, the option expenses of INR 7,50,000 – vested in Year 2 – will be booked equally in Year 1 and Year 2, and so on.

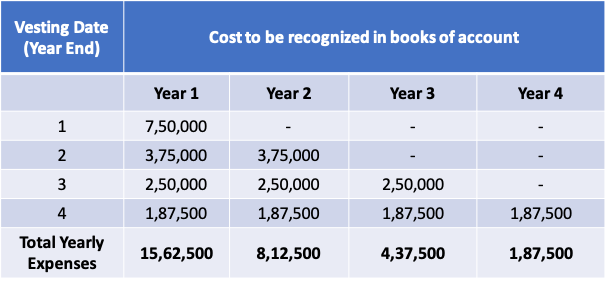

Below is the tabular presentation of the ESOP expenses to be booked year after year.

The above expenses can be recorded in the books of account with the accounting entry given below:

If the grant date is in-between years, such as 1st Jan 2020, then the expenses shall be distributed proportionally concerning the months before 31st March. This is because accounting entries are done on 31st March every year.

The below calculation can be used considering the above table. Assuming the options were granted on 1st Jan 2020, related expenses will be distributed as

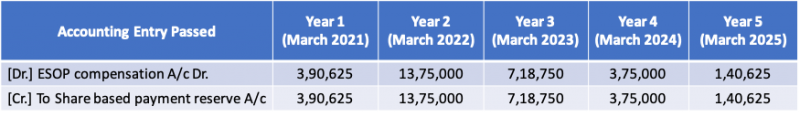

- Year 1 (31st March 2020):

Expenses per month in 2020 = 15,62,500 / 12 = 1,30,208.33

Expenses from Jan 2020 to Mar 2020 = 1,30,208.33 * 3 = 3,90,625 - Year 2 (31st March 2021):

Expenses from April 2020 to Dec 2020 = (15,62,500 / 12)*9 = 11,71,875

Expenses from Jan 2021 to March 2021 = (8,12,500 / 12)*3 = 203,125Total Expenses = 11,71,875 + 203,125 = 13,75,000

Similarly, the expenses can be calculated for all the remaining years. The complete table follows:

Important: To calculate option expense on multiple dates, use this worksheet.

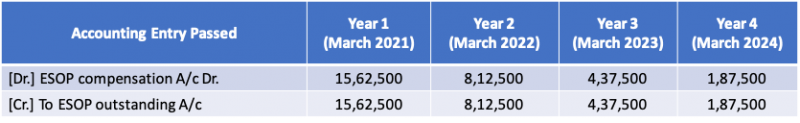

Graded Vesting Method for the companies using Accounting Standards

The method for expense calculation is the same as above. However, the accounting entries are changed.

In this case, it is assumed that options were granted on 1st April 2020.

Understanding ESOP Accounting is important but can prove to be extremely cumbersome for first-time entrepreneurs. trica equity makes the process seamless by allowing users to account for their ESOP grants digitally and generate reports at a click of a button.

ESOP & CAP Table

Management simplified

Get started for free